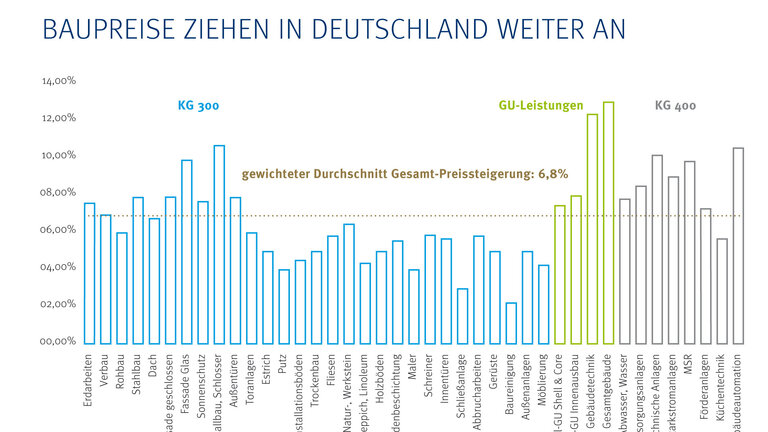

These are the key findings of the Drees & Sommer survey of construction cost trends, to which over 100 construction and engineering experts of this internationally active consulting and project management firm contributed their assessments of the current state of the market. From August through September 2017, the responsible product supervisors compared the budgets prepared by principals with the actual job costs for structural and technical building performances. Across all trades, the underlying construction volume on the basis of awards for the years 2016/2017 came to EUR 9.8 billion for 14 German states. The result: on average, the overall price increase for all trades comes to 6.8 percent Germany-wide.

For the over 40 essential construction trades, as well as full-service general-contractor services, the project supervisors initially estimated the market situation on the basis of responses to requests for quotations from 2016/2017. This provides an insight into the critical performance areas of the construction sector: the fewer quotations companies issue for specific types of work, the more likely it is that they will increase their prices for these services in the near future.

Accurate, up-to-date market indicators

‘Our survey provides extremely up-to-date indicators that accurately reflect the market as to trends in construction prices across all trades and in the individual federal states. This is essential for competent consulting and low-risk, on-cost and on-time planning of construction projects,’ points out Mirco Beutelsbacher, partner at Drees & Sommer SE, in explaining the motivation behind this internally prepared construction-cost and market barometer.

Stiff price increases particularly for more technically sophisticated construction services

Drees & Sommer found that clients in a construction project must currently expect price increases of over ten percent on average in particular for general-contractor services for the entire building, as well as for building services engineering. This is also the case for such technical services as building automation, ventilation systems and measurement and control technology. In these areas, response rates for requests for quotations range from less than 25 to 30 percent. In other words, just one quarter to one third of all queried companies bother to submit a quotation at all. Consequently, no easing of the price situation is to be expected.

The results indicate that greater bottlenecks and thus more likely price increases will occur in steel and metal construction, roof and façade work and glass façades, among other trades. Here as well, respondents report a quotation response rate that is frequently less than 25 percent.

Plan sufficient lead time before the start of construction

‘Particularly for extremely short-notice contract awards with short lead times, general contractors need to anticipate a risk of finding suitable subcontractors only at extremely high prices. And of course, this risk is reflected in the prices,’ notes Mirco Beutelspacher. ‘Due to the generally over-full order books, we advise our customers to plan sufficient lead times for awarding contracts and thus for the start of construction.’